Navigating financial hardships can be daunting, especially when it comes to significant assets like your home. However, considering national statistics, selling your home to an investor might emerge as a more viable option than plunging into bankruptcy. National statistics offer compelling insights into why selling your home to an investor trumps bankruptcy as a solution for homeowners facing financial distress. This data-driven approach highlights the effectiveness of investor transactions in averting foreclosure, expediting resolution, preserving equity, and fostering long-term financial recovery.

In this article, we delve into compelling data-backed reasons why choosing to sell to an investor could be a smarter move for homeowners facing financial distress.

Exploring Foreclosure Rates: Why Selling to Investors Matters

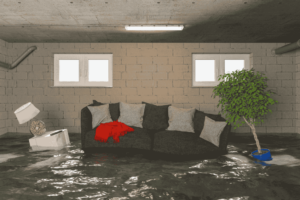

Foreclosure rates are a big worry for lots of families in the country. Every year, thousands of families face the scary possibility of losing their homes because of money problems. But there’s hope: selling your home to an investor can help you avoid foreclosure. These investors often give fast cash offers and make the selling process quick, which can really help families who are struggling.

When we look at national numbers, we see that selling homes to investors has actually helped lower foreclosure rates in different parts of the country. This shows that selling to investors is a good way to stop financial problems from getting worse.

Selling to investors isn’t just good for individual families—it helps whole communities, too. By selling quickly to investors, families can prevent their homes from being taken away, which helps keep property values stable and neighborhoods strong.

What’s great about selling to investors is that it gives families a way to take control of their situation. Instead of waiting for things to get worse with foreclosure, they can act fast and make a change for the better. This gives families hope and a chance to build a better future.

In short, foreclosure rates are a big worry, but selling your home to an investor can be a smart move to avoid it. It’s a quick and helpful solution that can make a big difference for families and their communities, giving them hope for a brighter tomorrow.

Why Selling Your Home to an Investor Might Be Better Than Bankruptcy

In the United States, a lot of people are filing for bankruptcy each year. This happens for different reasons, like losing a job, facing big medical bills, or having other money problems. When faced with these tough situations, many individuals see bankruptcy as their only choice.

But there’s another option: selling your home to an investor. This can be a way to avoid going through bankruptcy. By selling quickly to an investor, homeowners can turn their home into cash fast, which helps them pay off debts and get back on track financially.

Research shows that selling to investors instead of declaring bankruptcy can lead to a faster recovery. It means less stress and fewer long-term money problems. So, for homeowners in tough financial spots, selling to an investor could be a smarter move than bankruptcy.

When people face tough money problems, bankruptcy might seem like the only way out. But selling your home to an investor offers a different path. It can provide quick relief, help pay off debts, and lead to a faster financial recovery. So, for those considering bankruptcy, selling to an investor could be a better option to consider.

Solving Financial Problems: Why Selling to an Investor is Faster than Bankruptcy

When people face financial problems and consider bankruptcy, they often don’t realize how long and difficult the process can be. Bankruptcy proceedings can drag on for months, even years. This long wait can cause a lot of stress and worry for homeowners, who may feel uncertain about their future during this time.

But there’s a quicker solution: selling your home to an investor. Instead of waiting for bankruptcy proceedings to finish, homeowners can sell their home to an investor and get cash fast. Investors usually have fast timelines for closing deals and make the process simple. This means homeowners can sell their property fast and start focusing on fixing their finances.

National data shows that homes sold to investors spend less time on the market compared to those sold through traditional real estate channels. This means that selling to an investor can help resolve financial problems faster, giving homeowners relief from stress and uncertainty sooner.

When facing financial troubles, waiting for bankruptcy can be long and stressful. Selling your home to an investor offers a quicker solution. With fast closing timelines and simplified processes, homeowners can offload their property fast and start rebuilding their financial health sooner. So, for those looking for a faster way out of financial difficulties, selling to an investor may be the best choice.

Protecting Your Property: Why Selling to an Investor Beats Bankruptcy

When the economy takes a hit and property values drop, homeowners can lose a lot of their hard-earned money. This is especially tough for those considering bankruptcy, as they need to protect as much of their property’s value as possible to bounce back financially.

Selling your home to an investor can help safeguard your equity and prevent big losses. Investors often make fair offers based on the current market, ensuring that homeowners get a good deal for their property. By selling to an investor, homeowners can salvage their equity and avoid losing out on their investment.

National data shows that homeowners who sell to investors hold onto more of their equity compared to those who go through foreclosure or bankruptcy. This means that selling to an investor can help secure homeowners’ financial futures and protect their hard-earned money.

In conclusion, when economic troubles threaten property values, selling your home to an investor can be a smart move. By getting a fair offer and preserving equity, homeowners can protect their financial stability and avoid big losses. So, for those facing bankruptcy, selling to an investor offers a better chance at securing their financial future.

Conclusion:

National statistics paint a compelling picture of why selling your home to an investor is a prudent alternative to bankruptcy. From avoiding foreclosure and expediting resolution to preserving equity and reducing long-term financial strain, the data underscores the tangible benefits of this approach. As homeowners grapple with financial challenges, leveraging the option to sell to an investor can provide a lifeline towards regaining stability and securing a brighter financial future.