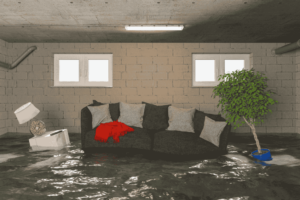

Every homeowner’s nightmare is water rushing into their home. Water damage and flooding can devastate a property, turning it into a burden rather than a blessing. Having a flooded or water-damaged house might have you wondering, “Can I sell it? ” The good news is, yes, you can. Additionally, you won’t have to deal with the headaches of traditional home sales.

Flood-damaged houses are challenging to sell, but you are not alone. Your valuable property can quickly turn into a financial burden due to natural disasters and plumbing problems. Are you looking for a fast sale for a flood-damaged house? Water-damaged properties can be quickly and easily purchased by cash buyers like Tando Advisors. Deals can be closed within days, not months, and they offer fair prices regardless of the damage.

Can You Sell a Flooded or Water-Damaged House?

Yes, you can sell a house that’s been flooded or damaged by water. However, selling a home in perfect condition isn’t always as easy. Especially if the repairs seem overwhelming or expensive, water damage can scare off traditional buyers.

However, there are property buyers who specialize in purchasing damaged properties. Investors or cash buyers who are willing to take on repairs themselves are often involved in these types of deals. Therefore, you don’t have to fix anything before selling. Selling your house as-is can save you time, money, and stress.

Sell a damaged property without worrying about the legal or financial implications. Tando Advisors specializes in handling such situations. They will guide you through the process, making sure everything is legal and ethical.

Understanding the Impact of Water Damage on Your Property

Water damage is more devastating than most people realize. A flood can cause more damage than just wet floors and walls – it can create a chain reaction that causes a series of problems that progressively become worse.

The first problem is structural damage. The presence of water weakens wooden beams, warps floors, and can crack the foundation of your home. Often, these issues continue to worsen even after the water is gone.

Mold begins to grow within 24 hours of flooding. It’s hard and expensive to remove it once it’s established. As a result, your property becomes harder to sell in traditional ways and poses health risks. The insurance may not cover all of the damage. Flood coverage is not included in many standard homeowner policies, leaving you with expensive repair bills. If you live in a flood zone, coverage can be extremely expensive or hard to obtain.

Preparing Your Home for Sale After a Flood

Flood-damaged homes must be thoroughly cleaned, repaired, and disclosed to potential buyers in a timely manner.

Initial Cleanup

Ensure that the home is thoroughly dried out to prevent mold growth. Make use of professional services for water extraction and drying. All water-damaged materials, including carpets, drywall, and insulation, should be removed and discarded.

It is crucial to disinfect floodwaters to eliminate bacteria and other contaminants. Make sure all moisture is removed with the use of commercial-grade disinfectants. Experts can help avoid future issues that could complicate the sale process.

Renovations and repairs

The structural integrity of the home must be addressed. Your flooring, walls, and foundation may need to be repaired. If your electrical system or HVAC unit has been damaged by water, you must replace them.

In addition, renovations might include decking, roofing, painting, and upgrading bathrooms and kitchens. Complete all necessary repairs to avoid deterring potential buyers and legal problems in the future.

Legal considerations and disclosure

It is legal to disclose past flood damage honestly. It protects you from legal issues and builds trust with potential buyers. Water damage and associated repairs must be documented and presented under disclosure laws.

Details regarding the water damage, remediation efforts, and mold treatment should be included. Both buyers and homeowners benefit from clear and accurate disclosures, which simplify the sales process.

Sell to a Cash Buyer:

There are companies like Tando Advisors that specialize in buying houses regardless of their condition, even if they have water damage. In this case, you can avoid repairs, staging, and long negotiations, which makes it the easiest and fastest option.

Dealing with Upside Down Mortgages After Flood Damage

An upside-down mortgage occurs when you owe more than your house is worth. Even if you had little equity before the flood, you can quickly find yourself underwater financially.

Homeowners often feel trapped, making payments on a damaged house worth less than their loan balance. Stress gets worse when you’re also paying for temporary housing or repairs. Even if you’re upside down on your mortgage, Tando Advisors can help. Short sales are negotiated with lenders, and they know how to deal with complicated financial situations.

Steps to Sell Your Water Damaged House Fast

Seek Guidance from a Top Real Estate Agent

Working with an experienced agent is the best way to navigate flooding-damaged homes’ unique challenges. Your agent will help you price your home appropriately, communicate effectively with potential buyers, and comply with local disclosure laws.

A water-damaged home agent should be knowledgeable about local and state regulations, have strong negotiation skills, and have experience working with home investors. Furthermore, they should have a thorough understanding of local housing markets and remediation costs.

Ensure Full Disclosure of Flood Damage

Legal consequences can arise if previous water damage is not disclosed. States have different disclosure laws, and some require detailed flood history disclosure.

Texas, for instance, requires sellers to disclose if the home has suffered past flooding, is in a floodplain, has flood insurance, or has received FEMA or SBA assistance. It is important to provide buyers with clear, non-alarming information in order to help them make informed decisions without deterring them from making them.

Provide details about flooding incidents, such as the number, depth, and if flooding occurred inside or outside the house. All remediation efforts, including repairs and compliance with state laws, should be documented. A real estate agent or lawyer can guide you through the disclosure process.

Choose Renovations Strategically

When selling a flood-damaged home, deciding how much to invest in repairs is crucial. You can maximize the value of your home by hiring a real estate agent who specializes in flood-affected properties.

Prioritize the following improvements:

- Carpet and flooring restoration

- Wall repair and repainting

- Repairing or replacing damaged furniture

- Mold remediation and certification

Homeowners can avoid unnecessary expenses by focusing on essential repairs.

Understand the Impact on Property Value

The market value of a home can be significantly impacted by flood damage, especially in the event of a natural disaster. The value of properties in flood-prone areas may drop by 20% to 30% after full repairs after water damage caused by issues such as broken pipes.

Factors such as flood frequency, depth of water intrusion, and flood insurance costs affect the extent of the value drop. In high-risk flood zones, buyers may have to pay high insurance premiums, which makes pricing even more important.

Gather All Necessary Documentation

Selling a home with a history of flooding requires proper documentation. Flood damage claims and repairs will be requested by buyers and their lenders. Provide the following information:

- Detailed records of repairs and remediation

- A record of who completed the work (a contractor or handyman)

- Invoices and receipts for all expenses

- Records of insurance claims

- Certification for mold remediation

- Flood insurance rates are affected by a FEMA elevation certificate

Flood insurance rates can be reduced when your home has an elevation certificate. The property would be classified as high-risk without one, resulting in a high premium.

Consider Transferring Your Flood Insurance Policy

It can be beneficial to transfer flood insurance to the buyer if you already have it. The following options are available:

- Assist the buyer with mortgage lender requirements

- Insure the buyer until the renewal date to reduce the closing costs

It can help you stand out from the competition if you offer this benefit.

Explore Selling to an Investor

A real estate investor might be a good option if you are looking to sell quickly without having to make repairs. You can save time and money by investing in as-is homes.

Advantages of selling to an investor:

- Renovations and repairs are not necessary

- Faster and easier closings

- No financing delays

Disadvantages of selling to an investor:

- Expected to receive a lower offer than market value

- Uncertainty about buyer’s intentions

- There may be unreliable investors

Tandoadvisors connects investors with cash buyers, expediting the sale process for sellers. In almost 10 days, homeowners can close the deal without facing traditional listing challenges.

Why Traditional House Selling Methods May Not Work

The process of listing a water-damaged house on the regular market is challenging. Buyers prefer move-in-ready homes over major renovations. Mortgages are usually required for regular buyers. Water-damaged properties are often not eligible for loans until repairs have been completed. Potential buyers are severely limited by this.

Your property might be reluctantly listed by a real estate agent. Many agents are concerned about liability issues if problems arise after a sale if water damage is disclosed to buyers. Even if you find an interested buyer, they will probably require expensive repairs or drastic price reductions. Carrying costs can add up for months during this process.

How Tandoadvisors Can Help?

Tando Advisors is aware of the unique challenges of selling a house that has been flooded or water-damaged. If you find yourself in this difficult situation, we will help you navigate it in a straightforward and compassionate manner.

- Fair Cash Offers: Our cash offers are honest and transparent, based on the current market value.

- Fast Closing: Often, we can close deals within one week, so you can move on quickly.

- As-Is Purchases: No repairs or renovations are necessary since we buy houses in any condition.

- Expert Guidance: We will guide you through the entire process, answering any questions you may have.

Making the Smart Financial Choice

Selling a water-damaged house quickly is often more cost-effective than holding onto it. Keep these expenses in mind:

- Mortgage payments

- Insurance premiums

- Property taxes

- Utilities

- Maintenance costs

- Possible code violation fines

When you sell to Tando Advisors, you can stop these costs immediately and move forward with your life. You can focus on your future while they handle all the headaches.

Conclusion: Your Path Forward

Don’t let water damage ruin your life. With Tando Advisors, you can sell your damaged property quickly and easily. They aim to make the process as stress-free and transparent as possible.

Are you ready to explore your options? Tando Advisors can provide you with thorough guidance and consultation. You can rely on their experts to guide you through the process and help you come up with the right decision.