An inherited house can be both a blessing and a challenge. There are potential responsibilities and complications associated with it, as well as financial opportunities. Tando Advisors are here to help you sell your inherited house fast if you recently inherited a property.

From understanding the probate process to overcoming common obstacles, we’ll guide you through the process of selling an inherited house. Whether you are dealing with a complicated estate or simply want to move forward quickly, this information will assist you in making informed decisions.

Can I sell my inherited property?

The sale of an inherited home is usually governed by probate laws. The probate process settles a deceased person’s remaining debts and distributes their assets to their surviving heirs or beneficiaries.

When the estate does not have enough cash to cover outstanding debts, an inherited property may be sold before being transferred. However, let’s assume the house you’ve inherited falls into this category and will sell a home in probate.

Selling Options for an Inherited House:

It is a big decision to sell your inherited property. Your experience and profits can be impacted by the right approach. Here are some options to consider:

Selling Through a Real Estate Agent

Agents bring market knowledge, experience, and negotiation skills. Their responsibilities include pricing, marketing, paperwork, and negotiations. In this way, the process is made as smooth and efficient as possible.

There is usually a commission of 5 to 6% on the sale price. A real estate agent’s expertise can, however, increase the sale price, potentially offsetting the commission. If you are unfamiliar with the selling process, agents are ideal for you if you value convenience, guidance, and expertise. Additionally, their network of buyers may enable them to achieve a higher sale price.

Private Sale

A private sale can save you money on estate agent fees and give you more control over the sale process. This strategy allows you to handle everything, from marketing to negotiations. This method saves commission costs but requires effort and knowledge of the market. It will take you a lot of time and effort to learn the process, find a buyer, and market your property.

Selling to a Cash Buyer like Tando Advisors

It is possible to sell your home to a cash buyer within a few days or weeks, offering a fast, hassle-free transaction. It is the perfect option if you are in need of a quick sale.

With Tando Advisors, you can sell your property quickly without the hassle or cost of repairs or lengthy negotiations. It is also chain-free and, since purchasers do not need to secure funding, the sale can be completed as soon as 7 days. As a result, you will gain certainty and speed, which can be particularly useful during the probate process or when it comes time to settle estate taxes.

Things to consider when selling inherited property in Texas

There are unexpected circumstances, such as mortgages and market fluctuations, that can sometimes prevail when inheriting a property in Texas.

- Dealing with inherited mortgaged properties

If you inherit a property with a loan attached, what should you do? This financial hurdle is explored along with your options. Having inherited a property doesn’t automatically make you liable for its mortgage. Payments are due until the home is sold or refinanced. Consult Tando Advisors qualified financial advisor to understand your options.

- The Short Sale Process

Selling the property quickly is a good idea if you don’t plan to keep it. Your mortgage payments will increase the longer you wait. Reduce your financial burden by working with an experienced real estate agent who specializes in quick sales.

- Renovations and Repairs

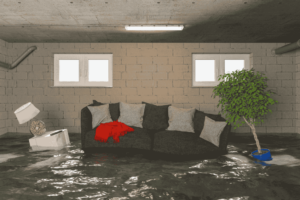

The price of an inherited property should account for the cost of repairs or renovations, especially if the property is vacant. A cash buyer who is willing to do the work themselves might also be interested in “as-is” sales. Market fluctuations may be more pronounced for distressed properties.

- Rental options

A property’s value may be impacted by these market changes, depending on the severity of the issues and the overall demand for the property. A local real estate professional from Tando Advisors can provide you with accurate insight specific to your situation.

You are not limited to selling your home. Alternatively, you may hold onto the property for future appreciation or rent it out to generate income. Consider the long-term implications of the decision as well as the financial implications.

When Can the Executor Sell a House That is in Probate In Texas?

The house shouldn’t be sold before probate. Before listing any property or doing anything else with the decedent’s assets, the executor must file with the probate court. In order to verify the will, the court must appoint or approve the executor. A property can be sold once everything has been validated by the executor.

Before accepting any offer on the house, the executor will likely have to submit an offer to the court for approval if the decedent has outstanding debts to creditors.

Do All Heirs Have to Agree to Sell a Property?

You’re right, it depends. When the heirs own the property jointly, they will need to reach an agreement, whether to sell it or to buy out one or more co-owners. Also, it may be determined by the state in which the property is located and the instructions given by the owner before his or her death. You should consult with an estate lawyer if you want to be sure.

A mediator can help resolve a dispute between joint owners if an amicable agreement cannot be reached. A judge may determine the case or they may need to refer it to the court. The process is typically a little simpler if one beneficiary wants to sell only their share. If the other beneficiaries agree, they can simply buy out the heir in question and divide up that person’s share.

Steps to Sell Your Inherited Property

- Consult an experienced probate lawyer:

Probate lawyers are skilled at guiding you through the legal process. In addition, they can assist you in avoiding common pitfalls and ensure all necessary paperwork is completed in a timely and accurate manner.

- Hire a real estate agent:

It is important to select an agent who understands the unique challenges of selling an inherited property. The experts can help you price the home correctly and navigate probate-specific requirements.

- Price the property competitively:

Having a realistic price based on current market conditions can attract more buyers. The probate process is likely to be shortened when a home is priced competitively.

- Preparation of the property for sale:

The home will look better if you clean, declutter, and make necessary repairs. Well-maintained properties are more likely to attract serious buyers and sell faster.

- Be open with all heirs and beneficiaries:

Inform all parties about the sale process and any decisions that are being made. Having open communication can prevent misunderstandings and delays.

- Alternative sale methods:

Sell your inherited house quickly by looking into options such as auctions or cash home buyers. In challenging market conditions, these methods can often speed up the sale process.

Sell Inherited Property in Texas With Expert Advice

This is all you need to know about selling inherited property in Texas. Selling property doesn’t have to be stressful, even though inheriting it is a wonderful gift. Obtain legal and real estate assistance and understand your options to navigate the process confidently.

Home sales can be stressful, but you don’t have to do it alone. You can easily and quickly sell your home with the Tando Advisors. You can get a fast cash offer on your house and start enjoying your peace of mind instantly.

Frequently Asked Questions (FAQs):

Can you sell a jointly owned property before probate?

Probate must be completed before the property can be sold. You can, however, prepare for the sale by consulting experts like Tando Advisors.

How does the sale of a property proceed if heirs disagree?

The property may remain unsold until a court ruling or mediation resolves the issue if heirs cannot agree. The heirs can also buy out each other’s shares.

Can the executor sell the house without the heirs’ consent?

An executor who is granted independent authority by the will may sell the property without the approval of all the heirs. All heirs must agree otherwise.

How long does it take to sell a house in probate?

Every step of the probate process, including the sale of property, must be approved by the court. Therefore, Texas probate houses can take a long time to sell. Selling the property to an individual could take six months or longer. The selling process can be slowed down further if any heirs contest the sale.

What are the tax implications of selling an inherited property?

A potential capital gains tax may apply if you sell an inherited mobile home for a profit. Consider options that will minimize tax burdens, such as donating the property or holding on to it for long-term capital gains.